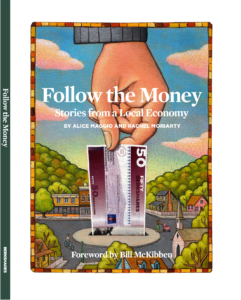

The following foreward to Follow the Money: Stories from a Local Economy was contributed by climate and environmental activist Bill McKibben. The book is a finely-printed collection from the entire BerkShares Business of the Month series to date, encapsulating the stories of the local economy and highlighting the importance of BerkShares local currency in uncertain economic times.

By the time this book is published, it will be just a hazy memory in the long list of crazy events that have marked recent years—but perhaps the image of the good ship EverGiven, piled absurdly high with containers and wedged in the bank of the Suez Canal, should stick in our memories. What kind of economy have we built that depends on the endless traffic in the kind of stuff that sits in those containers—and what kind of economy have we built that can come unstuck if a single waterway is blocked?

The opposite of the kind of the economy that Berkshares has been patiently building these past 15 years— the kind of economy whose story is compellingly told in the vignettes collected here.

Every one of these stories is about a business that can be compassed, understood: an inn where friends and travelers can gather, a gym where you can keep your body fit, a nursery that blooms with life each spring. What they have in common is that they are fixed in place, part of a community ecosystem. And like any healthy ecosystem, that is a guarantee of some resilience in a century that will require it. We sense our vulnerability with the pandemic, and even more strongly with the threat—no, the guarantee—of disruption that comes as we confront our future on a dramatically hotter, stormier planet. Instead of building an economy whose only principle is ruthless efficiency—an economy that worships ‘just-in-time’ production, and scorns the rights of workers, an economy that consolidates money in the hands of a few billionaires and leaves vast swaths of the nation hurting—we need economies that understand the value of rootedness.

BerkShares have many virtues, which is why the system has been of such interest over the years to scholars, and to practically-minded politicians who can tell something useful when they see it. But for me their greatest asset is the way that they build local community instead of eroding it. Too often money is a tool for divorcing us from our neighbors—at its logical end, a person with a credit card need never see anyone except the UPS driver again in his life. But that’s obviously dangerous: when the storm comes, UPS is not going to dig you out. And it’s sad: if the pandemic taught us anything, it’s how much we value those around us, and how difficult it is to be deprived of their company.

So as we return to ‘normal,’ or whatever passes for it in this chaotic century, let us look to the Berkshires for real inspiration. We don’t have to live our economic lives in ways that tear apart the places where we live; with a bit of commitment and experimentation, we can figure out how the genius of our places can be re- stored, preserved, enhanced. If you must think of it in purely economic terms, consider it a form of insurance: a wise policy taken out against the possibility that the global economy will wedge itself firmly in the sand, and that this time there won’t be a timely full moon to refloat it.

Insurance, though, doesn’t capture the delight that comes with neighbors, the pleasure that comes contact with those around you. Those pleasures shouldn’t be occasional; a working economy delivers them right alongside your sandwich, your book, your repaired bike. They are the joys no delivery driver can provide. BerkShares are, I think, necessary—but even if they weren’t, they are undeniably happy. Fifteen years from now, everyone will understand that.